US federal and state tax return preparation for nonresident students, scholars and professionals

-

Sprintax is the nonresident tax-filing partner of choice for TurboTax

Sprintax is the nonresident tax-filing partner of choice for TurboTax

-

Full IRS tax compliance guaranteed for foreign individuals

Full IRS tax compliance guaranteed for foreign individuals

-

Claim your maximum US tax refund

Claim your maximum US tax refund

Do I need to file a US tax return?

You must file a US tax return if you answer yes to any of the following:

- You worked while in the US as a nonresident

- You received a grant or income from a US source

- You received an allowance or stipend

- You did not work or receive funding in the US but you still need to file an Form 8843

How it works?

Step 1

Create your Sprintax account

Step 2

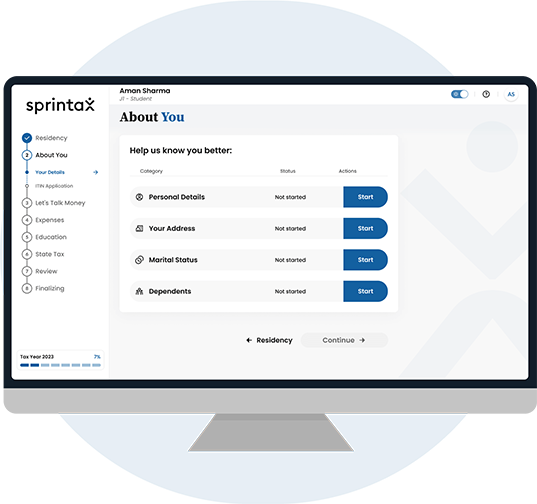

Answer some easy questions about your time in the US

Step 3

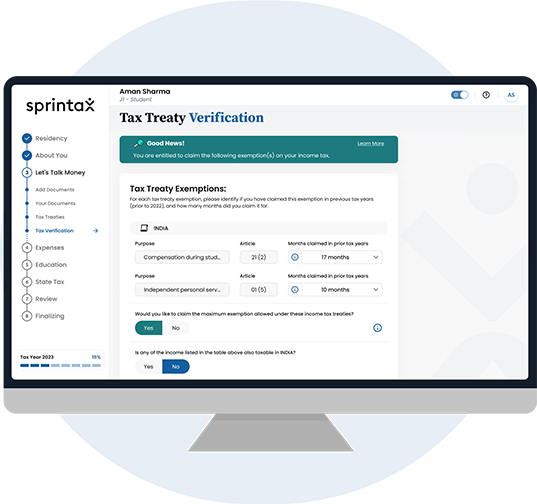

Sprintax applies every tax deduction and treaty benefit you are entitled to, saving you

money on your tax bill

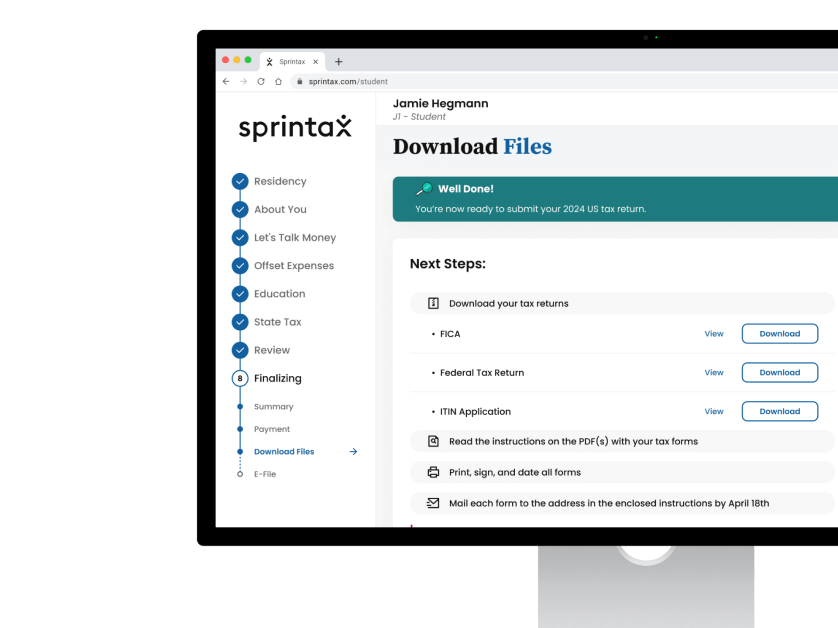

Step 4

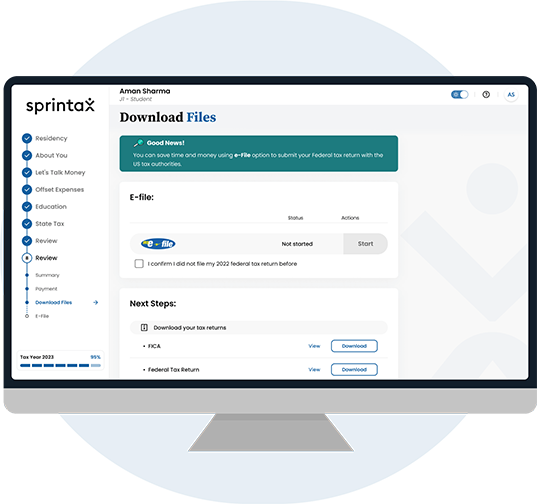

Sprintax prepares your completed tax forms and you can e-file your Federal return

Who can file with Sprintax?

Sprintax helps international students, scholars and nonresident professionals to correctly prepare their tax documents

- The most common tax mistake nonresidents make is to file their taxes as a resident. If you incorrectly file as a resident, you will breach the conditions of your visa. You may be hit with fines or penalties and even jeopardize future visa or green card applications.

- Every year Sprintax helps thousands of nonresidents (who are in the US on an A, B, E3, F, G1-G5, H1B, H2B, H3, I, J1, K1, L1A, L1B, M, O, P, Q or TN/TD visa) to file correctly.

- We will help you to determine your tax residency status and prepare your taxes easily online.

Why file with Sprintax?

Am I a nonresident?

Sprintax provides free tax residency determination

Tax compliance guaranteed

You will have a clean record with the IRS

Your maximum tax refund

Claim all of your US tax benefits with Sprintax

Round the clock tax support

Talk to the Sprintax live chat team anytime 24/7

Here's what our customers think

Very positive experience!

I’m a rising senior and used Sprintax to file my Federal and State taxes in the US, and had a great experience both times. Sprintax made my life much easier, because it allowed me to file these complicated forms with ease! I definitely recommend it to every international student in the United States.

Nice and easy.

Nice and easy.

This year was the second time I used

Sprintax. I am kind of new to tax filing, but Sprintax made things easy for me. I

was able to do everything by using instructional videos, emails from my college, and

the FAQ. I strongly recommend international students use Sprintax.

A fluid experience

A fluid experience. I am relatively new to the tax filing system in the USA, however, I was able to file my taxes with a few instructional videos, articles provided from my school, and the FAQ section. Would strongly recommend fellow international students to use to file their taxes.

Sprintax has made 'tax filing' super easy for international students

As an international student, I am very impressed by the convenience created by Sprintax in filing taxes. Sprintax has made the process pretty straightforward with a lot fewer details to worry about; clear explanations and an abundance of help on offer.

Great Services.

The services and the automated filling of form W-2 were great, and generating forms 8843 and 1040-NR saved a lot of time.

Sprintax is a great tool for filing US Taxes

Sprintax is a great tool for filing state and federal taxes in the US. Their interface is very user-friendly and I found the customer chat service really useful for asking any doubts.

Convenient

The instructions for each option are quite informative. The upload option enables filling a lot of information automatically, quite convenient.

My experience with Sprintax was really…

My experience with Sprintax was really good, it made filing US taxes very simple and easy to understand.

Easy for first timers

First time filing taxes as an international student. Very straightforward and simple process.