Sprintax Bundle

Your US tax toolkit!

Everything you need to remain tax compliant as a nonresident in the US.

Starting from $99.95 for a single tax year

What's included in the Sprintax Bundle?

If you are working in the US on a J-visa you will be required to file a tax return by the April 15th deadline. Sprintax can help ensure you are taxed correctly from the start by helping you prepare your pre-employment paperwork.

The Sprintax Bundle also includes a Federal and State tax return, FICA preparation and our post-filing support service so you can rest easy knowing your taxes are sorted!

Buy now, save later!

Save over $100 on your 2025 tax return with our early bird bundle discount!

Sprintax Bundle

- Federal tax preparation

- State tax preparation

- Additional State tax preparation

- Full Post-Filing Support Service

- FICA Preparation

- Sprintax Forms pre employment software

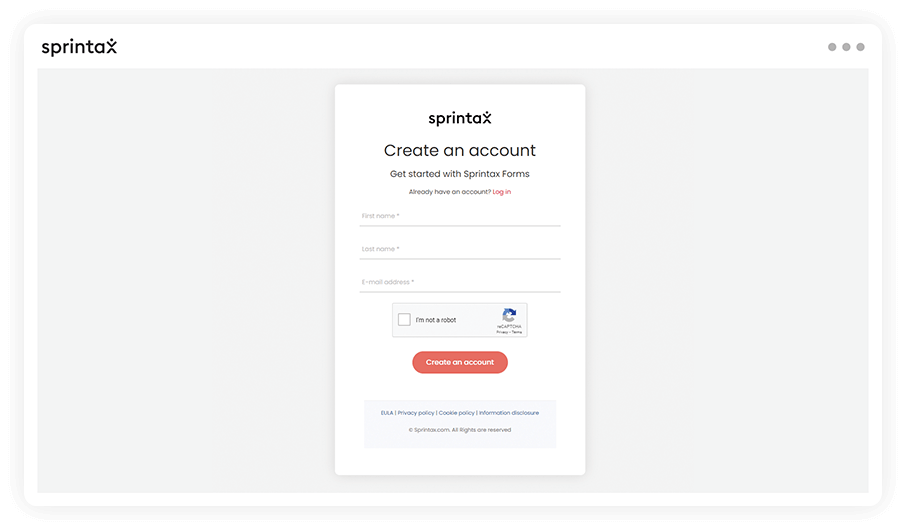

How It Works

Sprintax Bundle FAQ

Yes, all nonresidents must file a federal tax return. Even if you did not earn an income, you must still file Form 8843.

Depending on the state you reside in during your time on a J1-visa, you may also be required to file a state tax return.

The Sprintax Bundle was created specifically for nonresidents on J-visas. The Bundle makes it easy for nonresidents to prepare their US taxes online and stay 100% compliant with the IRS.

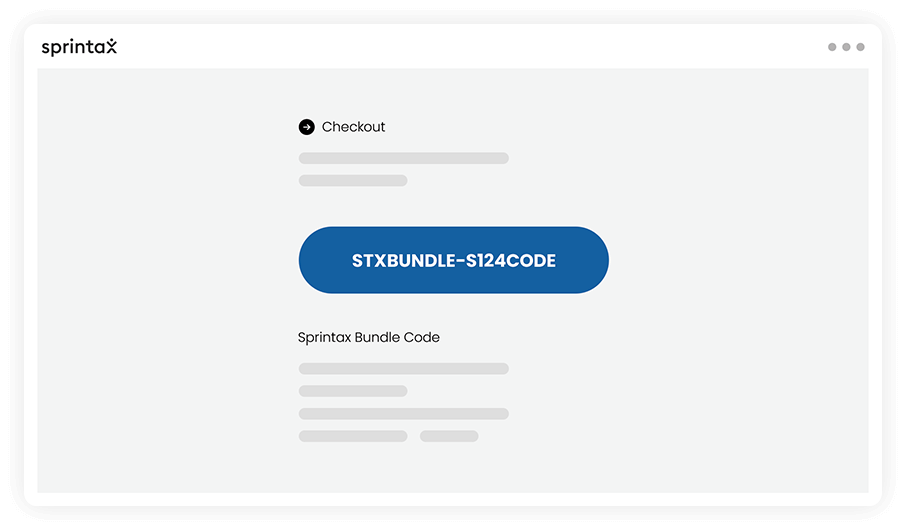

You can apply your Bundle code at the checkout.

If a nonresident doesn't file a tax return they may face penalties, this is typically 5% of the tax you owe for each month or partial month that your tax return is late, you may also face difficulties obtaining a US visa in the future.